Overview

SoFi, a leading digital bank, is dedicated to harnessing AI-driven innovation, process automation, and exceptional data management to empower its organization, particularly the Risk Management department. At the core of this initiative is the Fraud Operations team, responsible for safeguarding assets and maintaining customer trust by effectively detecting and preventing fraud through digital strategies and comprehensive data analytics. To enhance these crucial functions and boost the team’s impact, SoFi sought an AI-powered solution that enables rapid processing of vast data volumes, improves accuracy in fraud detection and mitigation, and streamlines monitoring and reporting processes to increase efficiency and reduce manual workload.

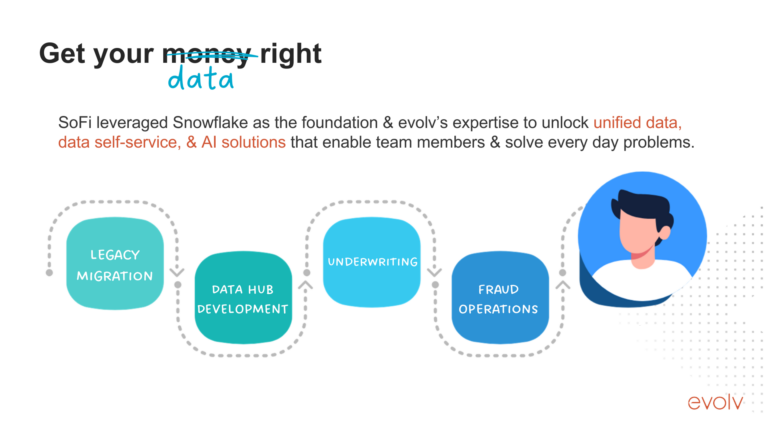

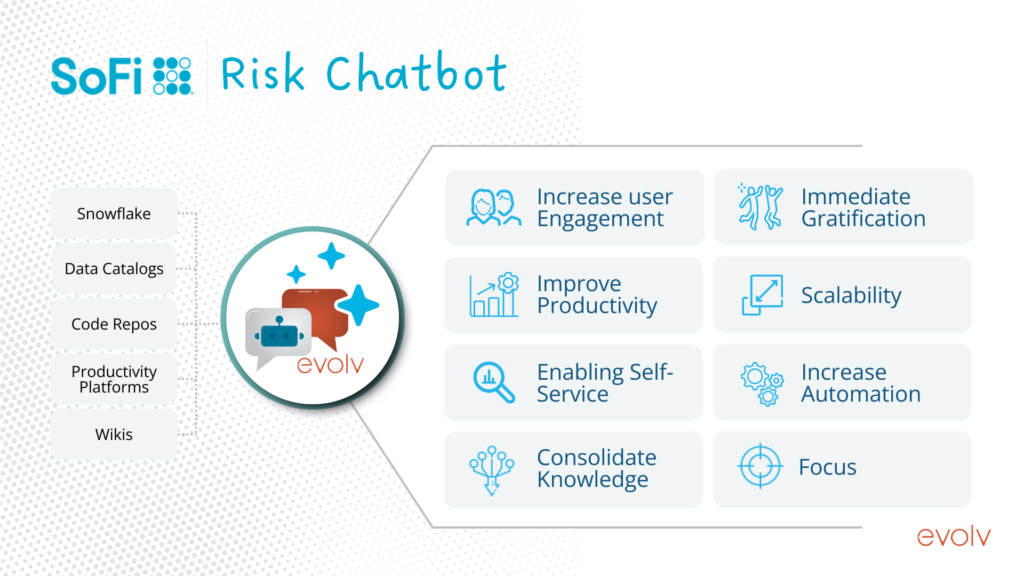

With a strategic vision in mind, SoFi partnered with evolv to develop and implement a Virtual Assistant tailored for the Risk Data Platform, powered by Snowflake’s Cortex and Artic technologies. A key factor in the collaboration’s success was evolv’s prior work with SoFi, particularly their role in SoFi’s digital transformation from the Postgres system to the Snowflake platform. This shift improved data quality, performance, and usability within SoFi’s Risk Infrastructure, enhancing fraud prevention and promoting ongoing innovation. SoFi’s partnership with evolv underscores their commitment to becoming a leading AI adopter within the industry, skillfully leveraging Snowflake’s capabilities to maximize the value of their data.

tech stack used

Solutions

st

solution

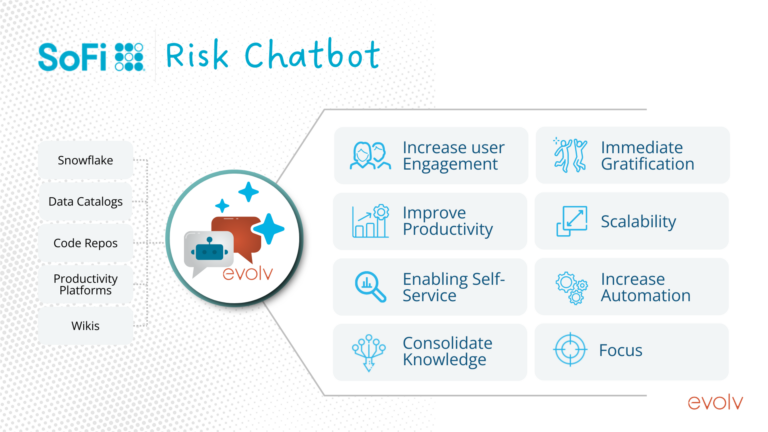

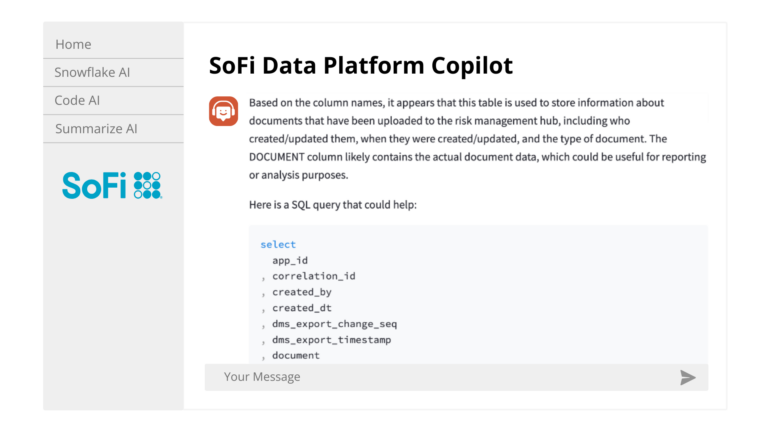

SoFi's Fraud Operations have been transformed by the AI-driven Risk Data Platform Chatbot, developed by evolv.

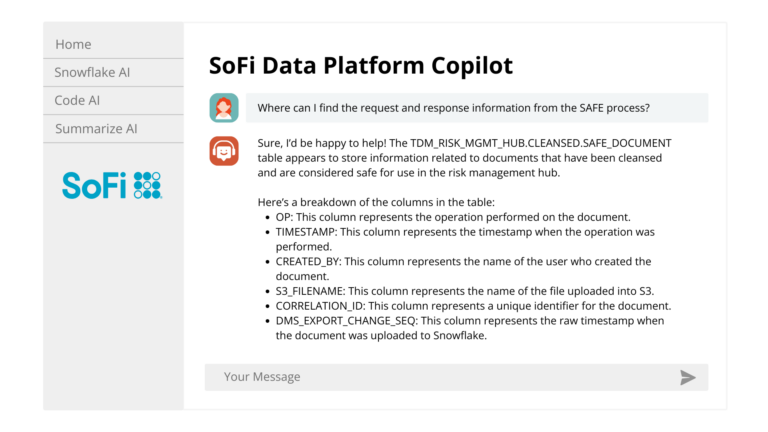

The dedicated Fraud Operations team, consisting of analysts, investigators, and risk managers, is committed to identifying, preventing, and mitigating fraud to safeguard the company’s assets and customer data. Employing predictive and preventative strategies, they use rules and investigative queries to expertly detect fraud patterns in the financial services industry. The chatbot utilizes Large Language Models (LLMs), Cortex-powered processing, and advanced AI technologies to handle repetitive inquiries efficiently and provide data for in-depth analysis. Designed to enhance team efficiency, the RiskChatbot streamlines data access, accelerates the implementation of fraud strategies, improves their success rates, and significantly increases the value extracted from SoFi’s data through Snowflake Native Apps. As a result, analysts can now concentrate on strategic tasks, boosting overall efficiency.

Key Features & benefits

- Instant Data Retrieval with Cortex

- Real-time Thread Detection

- Scalable & Adaptable Solution with Artic

- User-Friendly Interface

- Process Automation with Native Apps

- Enhanced Knowledge & Data Access

approach

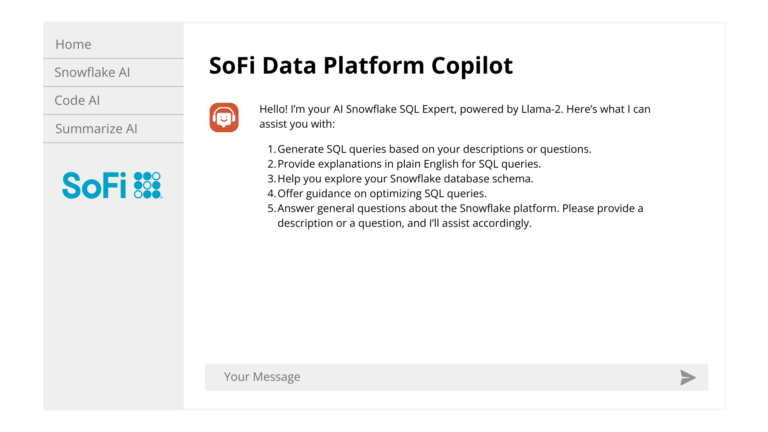

In this project, evolv harnessed SoFi’s existing tools for an efficient and seamless integration and maximizes Snowflake’s Native Apps benefits. The aim was to advance data extraction and processing through sophisticated scripting to streamline the automation of the Retrieval Augmented Generation (RAG) architecture. These scripts utilize APIs to seamlessly integrate Snowflake’s Snowpark tool and its container services, ensuring efficient and secure data management. APIs play a crucial role in connecting the different architecture components, facilitating smooth data flow and processing.

- Text Embedding Process: Using advanced models, text data is transformed into meaningful vector representations, allowing for the extraction of rich, context-aware insights.

- Data Workflow Scheduling: Implementing automated scheduling tools enhances operational efficiency by ensuring scripts run at set intervals, reducing the need for manual intervention and keeping systems updated.

- Performance Optimization through Smart Updates: Cortex improves system performance by processing only new or modified data, ensuring accuracy and responsiveness in real-time decision-making.

action steps

1

Conduct Comprehensive User Training: Organize training sessions for Fraud Operations personnel to ensure they understand how to effectively use the AI chatbot as a supplementary tool, emphasizing the importance of applying critical judgment alongside its insights.

2

Establish Continuous Feedback Loops: Implement a structured process for collecting user feedback post-launch. This will facilitate timely adjustments and enhancements to the chatbot based on real-world usage and user experiences.

3

Schedule Regular System Audits: Conduct routine audits of the chatbot’s queries and responses to ensure accuracy and completeness. Collaborate with experienced fraud analysts to validate the information and make necessary model refinements.

4

Automate Data Updates: Leveraging Arctic, automated workflows ensure constant access to the most up-to-date risk data without manual overhead, enabling robust fraud detection.

5

Monitor and Adjust Rollout Phases: Continuously assess the effectiveness of the phased rollout plan, making adjustments as needed to expand the chatbot’s data accessibility and applicability beyond the initial Risk department audience.

results

With Snowflake’s Cortex and Arctic technologies fully integrated into its Risk Management workflows, SoFi is poised to further enhance AI adoption across its financial services platform. By expanding the reach of these tools beyond Fraud Operations, the organization aims to strengthen core data-driven strategies, setting the stage for broader innovations and solidifying its leadership in secure, AI-enhanced financial services.

Enhanced Strategy Development

Snowflake Cortex empowered the team to elevate monthly strategy development from 15 to 25 tailored plans, boosting agility.

Improved Strategy Success Rates

Detection accuracy increased to 90%, reducing false positives and improving decision-making confidence via Cortex-powered analytics.

Time Savings & Boosted Morale

By using Native Apps, integration costs dropped significantly, while Arctic scaling features eliminated redundant processes, saving operational expenses.

Enhanced CX & Trust

Optimized fraud detection reduced customer complaints by 30%, reinforcing trust and long-term loyalty.