by Gabriel Grynsztein

By implementing agile governance and automating repeatable tasks, evolv helped one financial institution generate $6 billion in digital deposits. But that was just the start.

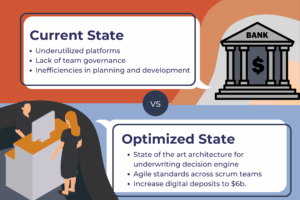

Background: One of the fastest growing banks in America asked evolv to help grow their risk management team across three loan products. The assignment was clear: improve loan underwriting so that the bank can grow digital deposits to $4.5 billion. But the bank also had to comply with financial regulations as part of its goal of obtaining Office of the Comptroller of Currency (OCC) approval on a national charter, which would allow it to operate under federal rules instead of those in individual states.

Challenge: The bank’s underwriting systems, built on Provenir’s decision engine, were underutilized, leading to inefficiencies and compliance gaps. Furthermore, a lack of governance in the team’s working way led to confusion, delays, and misprioritized opportunities. Understanding the root cause was an initial challenge, as stakeholders were not sure if a costly migration to another Decision Engine was going to solve their problems.

Solution: evolv addressed these challenges by creating a comprehensive program that focused on Provenir’s strengths and agile governance standards. This helped avoid a costly and time-consuming migration. This collaborative approach also aligned different department goals into one while still embracing the bank’s work culture. The decision quickly paid off, as the bank generated $6 billion in digital deposits, surpassing their goal by 36%, and helped secure National Charter approval from the OCC.

Our Tool Kit

This collaboration displayed evolv’s ability to transform complex systems into scalable models so that our clients can reuse solutions for future projects. evolv’s experience in the financial services industry helped drive the initiative’s success. We leveraged a suite of existing tools and brought in new ones to streamline operations:

- OpsGenie and Datadog: These tools supported 24/7 on-call rotations, with automated monitors to detect anomalies in less than 5 minutes, a 99% improvement from the previous time of 24 hours. Error logs and fixes were sent to on-call staff, ensuring quick resolution and targeted a 99.9% uptime.

- Provenir: evolv revamped the original architecture, reducing full refresh times by 92%, from 72 to 6 hours. Data reporting times also decreased, from 48 to 8 hours. Automated processes minimized risk, ensured compliance, and enabled near-autonomous loan funding.

- Jira: Configured for multi-team collaboration; Jira held a healthy backlog of product and process improvements. This ensured the team delivered business value while carving out time to remove any technical debt. The team also built dashboards to provide product owners with key metrics such as releases, velocity, and burndown charts.

- Confluence: Built as the central repository for documentation. Confluence easily integrated with Jira, Airtable, and Google Suite for a one-stop-shop. This ensured all employees could access project details, which reduced overhead for project managers, scrum masters, and developers.

- Airtable: Hosted annual and quarterly target goals for high-level planning. Executive dashboards were automated to track KPIs for deliverable & risk. evolv took it a step further and linked executive milestones to Jira’s scrum board for real-time updates to track alignment with quarterly and annual milestones.

This program positioned the bank as a leader in digital transformation, achieving scalability and compliance. evolv’s training ensured the bank could maintain these systems independently, maximizing long-term value.

Future Trends

The financial industry is evolving rapidly, and evolv’s expertise can equip banks to navigate these changes. Here what to look out for:

- Snowflake for AI-Driven Underwriting with Snowflake: Snowflake can help unify massive datasets such as financial, marketing, geographical, and more into AI-driven underwriting models. Snowflake’s scalability supports hyper-personalized, real-time loan decisions, enabling banks to triple underwriting speed and capture new market segments with precision. Allowing AI to adjust underwriting rules within legal and risk parameters based on real-time data can customers to get the best rates while banks take on minimal risks.

- Snowflake Cortex Agents: Cortex Agents help non-technical users simplify analytics, ensure compliance, and streamline complex workflows so that risk departments can focus on strategic tasks like mitigating fraud and assessing credit risks, rather than managing analytics infrastructure. Cortex Agents also minimizes the cost of running complex queries so that risk departments can access information without overprovisioning.

Grow With evolv

evolv’s expertise helped transform a bank’s status from State to a National Charter, and by implementing agile governance and automating repeatable tasks, evolv helped generate $6 billion in digital deposits! As banks continue to find ways to grow deposits while reducing risks, they are beginning to embrace process mining and data-driven models. Ready to elevate your operations? Partner with evolv for transformative growth.

Gabriel Grynsztein is a seasoned Senior Consultant at evolv Consulting and one of the company’s longest-serving team members. Drawing on his extensive background in financial services, Gabriel excels at using cutting-edge tools like Snowflake to create smart, data-powered solutions that make a real impact. He’s backed by key certifications such as CSM, PSPO, and PMP, which highlight his strong foundation in agile practices and project leadership. From his home-base in Miami, Gabriel brings a proven record of success making him a go-to expert for driving meaningful change in the industry.