Overview

New American Funding (NAF), a prominent U.S. mortgage firm, faced significant inefficiencies within their accounting department, primarily due to the laborious manual processes used to manage purchase advices. With an influx of documents from 40-50 investor organizations, the team encountered a daunting task in handling the large volumes of files in their specified formats. With AI tools now accessible on Snowflake’s CORTEX platform, they pondered the extent to which they could effectively automate the account reconciliation process. Their seasoned and innovative CFO collaborated with evolv Consulting to explore this potential.

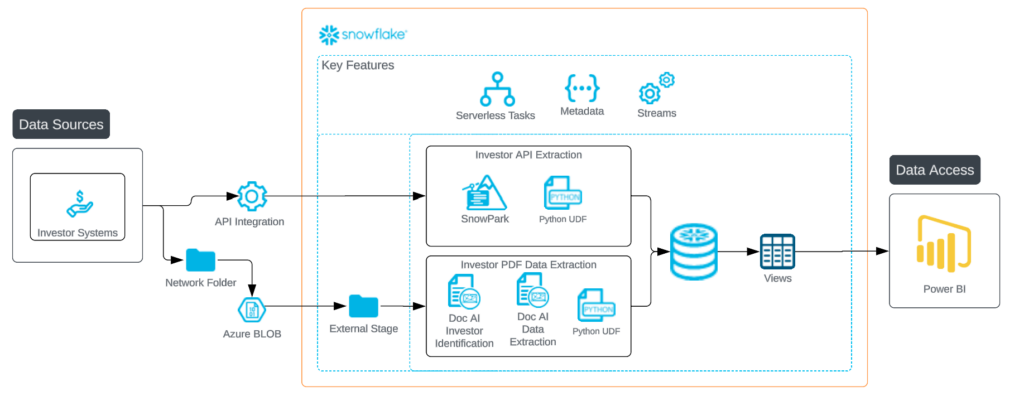

tech stack used

Solutions

st

solution

Leverage AI & custom LLMs to fully automate NAF's Account Reconciliation process for the accounting department.

With evolv’s AI-based solution accelerator, IDP (Intelligent Document Processing), evolv harnessed AI to automate the entire document preparation, data sourcing, and data handling process within Snowflake – on an accelerated timeline. Designed specifically for the mortgage industry, this solution ensures optimal performance with minimal human intervention after the initial setup.

The end to end solution for NAF included automatically retrieving financial data, accommodating investor-specific requirements and formats, and ensuring full data entry, processing and storage with robust security and governance. Previously, the team needed to access various portals multiple times a day to gather information from investors. Now, this process is entirely integrated in real-time, allowing the team to focus on more strategic tasks and enhance their value across the organization.

targeted metrics for improvement

- Faster Approvals

- Increased Efficiency

- Higher Productivity

- Improved Accuracy

- Enhanced CX

- Competitive Advantage

approach & action steps

1

Assessment of Challenges: Conducted a comprehensive analysis of NAF’s current document processing workflow to pinpoint pain points and inefficiencies within the investor organizations handling the ~70% of their loan volume: Fannie Mae, Freddie Mac, and Ginnie Mae.

2

Design and Development: Building on evolv’s IDP – Intelligent Document Processing industry solution, we developed a bespoke AI system tailored to efficiently manage and streamline data extraction from various PDF templates. This solution incorporates key Snowflake capabilities via Cortex, such as DocumentAI, Artic, and custom LLM models.

3

Testing and Validation: Conducted several proof-of-concepts and pilot programs to verify the solution’s accuracy and its ability to effectively manage exceptions. Custom measures were implemented to ensure DocumentAI met our desired speed and accuracy standards.

4

Deployment: Following our POC results, the team successfully implemented the solution, seamlessly integrating it into NAF’s accounting processes. This resulted in immediate improvements and positively impacted a significant portion of the organization, extending beyond the Accounting department. evolv continually monitors and tracks the solution’s performance through a Streamlit dashboard and provides ongoing training to familiarize the accounting team with performance monitoring capabilities.

5

Continuous Improvement: Implemented feedback loops to continually refine the solution, enhancing its accuracy and efficiency over time.

results

Efficiency Gains

Reduced manual document processing time by over 80%.

Increased Throughput

Enabled the accounting team to process an average of 6+ documents per minute.

Enhanced Data Accuracy

Improved data integrity through model optimizations and quality checks.

Operational Flexibility

Allowed the addition of smaller investors without increasing workload.

benefits

Time Savings

Freed up 15 hours per week for strategic tasks, shifting focus from manual processing to more valuable activities

Scalable Framework

Provided a scalable solution framework for integrating an additional 50 low-volume investors seamlessly.

Cross-Departmental Impact

Improved data integrity through model optimizations and quality checks.